Understanding your financial choices: a look at Members 1st

Stop into your CHS Bison Buck Members 1st on Mondays and Fridays, 10:45am-12pm.

November 17, 2014

One might say “What’s the difference between a credit union and a bank? I always thought that they were the same…” This however is not the case.

There are many differences between a credit union and a bank. One of the main differences between the two is that a credit union is not in existence for making profit, but is in existence solely for providing exceptional services to its members. Banks exist to make a profit and make business decisions based on what is best for their stockholders.

Another main difference between banks and credit unions is when someone uses a credit union, they are called “members” instead of “customers” and each member actually owns an equal piece of their credit union. Also, in a credit union, the income is returned to its members to give them better savings rates, lower loan rates, and low or no fees for certain services. With a bank, the profits are returned to the stockholders to give them higher dividends on their shares of stock.

Taking all of this into consideration, someone might say “Wow! A credit union seems to be the way to go!” And they would be right; credit unions and banks offer many of the same services, but it’s the member service that sets them apart from everyone else. That’s why at Members 1st, their name says it all. We put our members first!

A Brief History

It all began in 1950 with a small desk outside the personnel office at the Naval Supply Depot in Mechanicsburg, Pennsylvania. After 22 years of operation in 1972, this small, nameless credit union adopted the name the Defense Activities Federal Credit Union (DAFCU). In that same year, DAFCU moved up and onward from one small desk into its second location at the U.S. Army War College in Carlisle. Continuously committed to superior member service and with a fast-growing rate of membership, Members 1st Federal Credit Union, whose name was changed again in 1994, became the credit union many use today.

CHS Members 1st Bison Buck

This Members 1st branch, although smaller than others in the area, is fully functional and ready to use right in school. The Bison Buck opened its doors in November 2010, making the 2014-2015 school year its fifth year in operation.

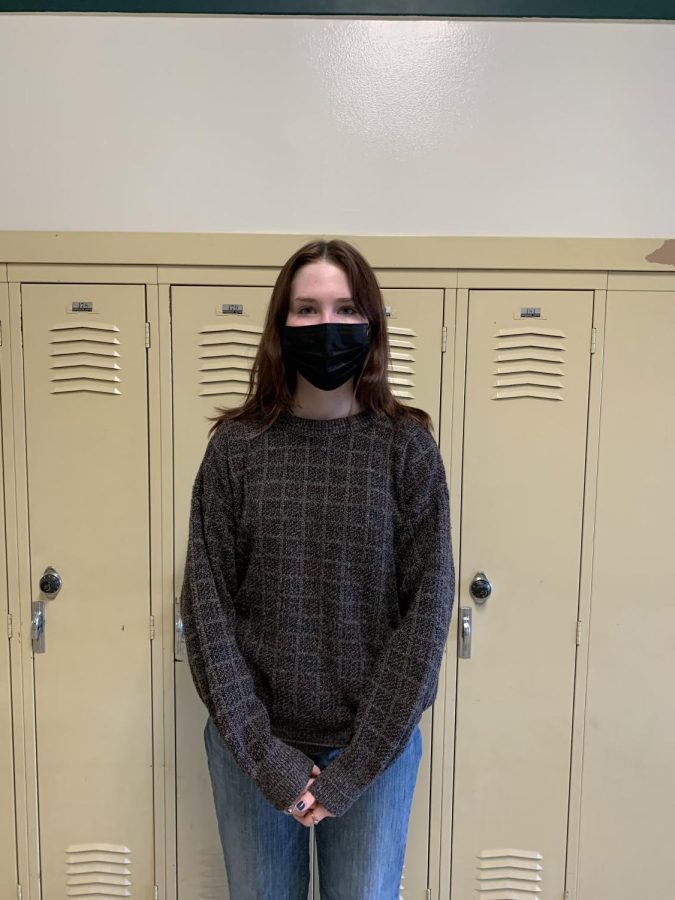

The branch is open every Monday and Friday from 10:45 a.m. to 1:00 p.m. Bison Buck is open to all students and faculty members to do all the business they would normally do at a regular Members1st branch right in the comfort and convenience of CHS. Carlisle school district’s partnership with Members 1st has given students many wonderful opportunities and experiences to apply what they’ve learned so far in class to real-life circumstances.

So far, there have been a total of five students working in the Bison Buck along with a Members 1st representative. In its first year of operation, Brooke Clippinger represented CHS’s Bison Buck. In 2011-2012, Zach Chini was Bison Buck’s student rep. In 2012-2013, the student rep was Cody Myers, and last year the Bison Buck rep was Emily Keating. This year, our fifth year in operation, Taylor Monroe is the Bison Buck representative.

We have a lot of great deals, fun opportunities, and even contests for students and faculty members to participate in. Keep on the lookout for future announcements about the Bison Buck and enjoy the school year!

Taylor Monroe is a student representative of Members 1st. This article is part of her position’s responsibilities. Please stop in the CHS Bison Buck and see her!

Brianna Robison • Jan 21, 2015 at 8:24 am

Love the convenience of having the bank right in the middle of our school!

Logan Redcay • Jan 15, 2015 at 8:40 am

This article had some very useful facts because its true most people don’t know the difference between a credit union and a bank. However, after reading this article the difference is clearer and I feel I have a better understanding than before.

Kenleigh Peet • Nov 20, 2014 at 12:33 pm

Having the bank here at school has benefited me many times, both this year and last. From depositing paychecks to pulling out some lunch money, they’re always super helpful and it’s nice to be able to take care of my financially business without having to make an extra trip.