Financially preparing for the future? Take it one year at a time

College requires a lot of dollars and cents, not just intelligence.

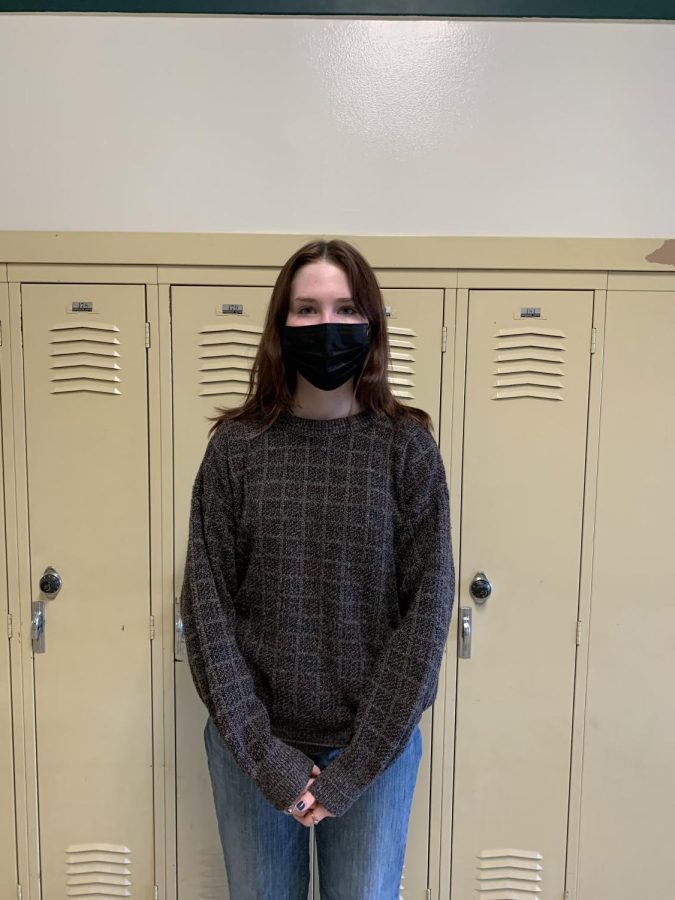

Our guest writer, Emily Keating is a Carlisle senior who currently serves as this year’s Student Ambassador of the Bison Buck, the Members 1st branch on the Carlisle High School campus.

Finances are extremely important when it comes to preparing for college. It’s important that you start early so that you have enough money for all of the expenses such as tuition, books, and room and board.

There are many steps in order to financially prepare for college.

In freshman year, start looking at financial institutions. This is most important to do during freshman year of high school. Pick a financial institution where YOU are the most comfortable and build a relationship with that institution.

Once your account is opened, you should set up a schedule to deposit a set amount of money. Keep to that schedule as much as possible.

Sophomore year is just as important for finances. By now you should be keeping to your schedule of deposits.

Another way to earn interest is to open up a Share Certificate. They have a slightly better interest rate. At Members 1st Federal Credit Union, there are special rates that are offered on certificates. If you open up a few certificates, you can earn even more interest on your money while it is just sitting there.

If at all possible, start looking for a job such as babysitting, being a server, or working at a summer camp.

In junior year, start looking at the different types of student loans that your financial institution offers. If you have a job, ask if your employer offers direct deposit for your paycheck.

At Members 1st, you may set up direct deposit for either the savings or checking account. If you are trying to fill course selection forms and need classes, take a personal finance class.

Senior year is one of the more stressful times to even think about finances for college. Next year, you will go to college and taking a class in personal finance will be helpful in developing the skills needed not only for college but for the rest of your life. Decide where you will go and talk to a financial planner or investment officer.

Members 1st FCU offers free seminars about student loans and the application process. These seminars are very informative for parents and potential college students. For more information about these seminars, call (800) 283-2328, ext. 6017.

If you have any questions or would like to open up an account at Members 1st FCU, just stop into the CHS school branch, which is open Mondays and Fridays from 10:30 a.m. to 1 p.m.. We will help you and address any of your financial questions.

Want to help the Herd? Please consider supporting the Periscope program. Your donation will support the student journalists of CHS and allow us to purchase equipment, send students to workshops/camps, and cover our annual website hosting costs.

This is Mrs. Muir's 13th year advising Periscope and she loves it more every year! She's an avid reader, loves dogs and being outside, and enjoys baking...

Caitlin Dull • Apr 28, 2014 at 7:51 pm

Very good article! Yey to Emily!!!